Welcome to our new article, “What is WETH? Discover the Mystery Behind the New Virtual Currency!” In the era of blockchain and cryptocurrency development, updating knowledge is extremely important. You might have heard about Ethereum, but WETH is probably a new concept for many. In this article, we will detail WETH – a variant of Ethereum – and guide you on how to own it. Whether you are a beginner or experienced in the field of cryptocurrency, our information will help you understand more about WETH and how it works. Let’s explore and expand our knowledge in the world of cryptocurrency through this article!

What is wrapped Ether (wETH)?

If you are starting to approach the world of DeFi (Decentralized Finance) or dApp (decentralized application) projects, you will often hear about a cryptocurrency called “wrapped Ether” or wETH. So what is wETH? Let Connextfx explain to you.

To begin with, wETH is a “wrapped” version of Ether (ETH), the most popular cryptocurrency in the world. Simply put, wETH is ETH “wrapped” in a smart contract on the Ethereum network. What are the benefits, you might wonder?

First, wETH allows ETH to participate more conveniently in activities and transactions on the Ethereum blockchain. Ethereum was not originally designed to handle complex financial transactions, but with the advent of wETH, users can use ETH to easily participate in various dApps or different cryptocurrency exchanges.

Second, wETH helps to increase the liquidity of ETH on DeFi exchanges. This means that users can easily exchange ETH for other cryptocurrencies and participate in advanced trading processes without having to convert ETH to other tokens.

In summary, wrapped Ether (wETH) is an important tool in the Ethereum DeFi ecosystem, simplifying and improving the liquidity of Ether in decentralized applications. If you are participating in DeFi or interested in Ethereum, understanding wETH is important..

How does wrapped Ethereum (wETH) work?

Converting ETH to wETH:

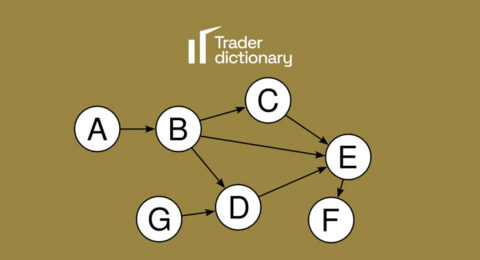

To start, you need to understand that wETH is a variant of ETH. This means that you can convert ETH to wETH and vice versa through a smart contract on the Ethereum blockchain. When you do this, your ETH is locked and creates an equivalent amount of wETH. This helps you participate in DeFi applications and transactions on Ethereum more easily.

Maintaining value and liquidity:

An important point is that wETH retains the value of ETH, as it is linked 1:1 to ETH. This ensures that you don’t lose value when converting. Moreover, wETH creates liquidity for ETH on DeFi exchanges. Users can exchange wETH for other cryptocurrencies or participate in financial borrowing/choices without losing their liquidity.

Integrating with DeFi applications:

WETH can be used in many DeFi applications, like Uniswap, Compound, or MakerDAO. You can participate in providing liquidity, borrowing, or even participating in yield farming processes using wETH. This creates opportunities for users to take advantage of decentralized financial services on Ethereum.

How to wrap Ether (ETH)?

Now let’s talk about how to wrap Ether (ETH) into wETH. Don’t worry, this is not a difficult task. Let’s go through the process with Connextfx.

Step 1: Use Dapp or Exchange: First, you need an Ethereum wallet, and you must have some ETH in it. Then, you can use a decentralized application (Dapp) or an exchange that supports the wrap ETH function. Research online for popular options like MetaMask, MyEtherWallet, or Uniswap.

Step 2: Activate the wrap function: Once you have accessed your wallet or exchange, find the wrap or wrap ETH function. Usually, you will need to enter the amount of ETH you want to wrap. It is important that the ratio between ETH and wETH is always 1:1, so you will receive the same amount of wETH as the ETH you wrapped.

Step 3: Confirm and Wait: After you have entered the amount of ETH and confirmed the transaction, the smart contract will process and create the corresponding wETH. This process usually takes a short time. It is important not to cancel the transaction after confirmation to avoid unnecessary transaction fees.

Step 4: Use wETH: Once you have wETH, you can use it in DeFi applications or trade on exchanges. Remember that wETH is still ETH, just a variant of it, so you can still convert it back to ETH at any time. That’s it! You now know how to wrap Ether into wETH. This will help you participate in the decentralized world on Ethereum more easily. Good luck!

Explore how you can use the wETH smart contract on OpenSea to participate in this digital art market:

Using the wETH smart contract on OpenSea:

Log into OpenSea: Visit the OpenSea website and log in to your account. Search for artists and artwork: Browse OpenSea to find artists and artwork that interest you.

Select artwork and shop: When you find a piece you want to buy, select it and complete the transaction using wETH.

Connect wallet and transfer wETH: OpenSea will ask you to connect your Ethereum wallet and transfer the necessary amount of wETH to the wallet on the website.

Confirm the transaction: Confirm the transaction in your wallet and wait until the transaction is confirmed on the blockchain.

Own the artwork: After the transaction is completed, you will own the artwork in your account.

Capture value and liquidity: With the artwork purchased using wETH, you can track its value and even sell it back to make a profit. Participate in the community: OpenSea also has a vibrant community, where you can join conversations, post, and express your passion for digital art.

Using the wETH smart contract on OpenSea helps you conveniently participate in the digital art world and ensures liquidity for your artwork.

Creating wETH through Uniswap:

Let’s explore how to create wETH through Uniswap, one of the most popular ways to do this on the Ethereum network, with Connextfx.

Access Uniswap: First, visit the Uniswap website (Uniswap V2 or V3 depending on the version you want to use).

Connect Ethereum Wallet: To use Uniswap, you need to connect your Ethereum wallet to it. This ensures you have the authority to make transactions.

Select wETH from the list: On the Uniswap interface, you will see a list of tokens. Search for wETH in this list.

Enter the amount of ETH: After selecting wETH, you need to enter the amount of ETH you want to wrap into wETH.

Confirm the transaction: Uniswap will show you detailed information about the transaction, including exchange rates and transaction fees. Confirm the transaction after checking this information.

Wait for confirmation on the blockchain: Your transaction will be presented and wait for confirmation on the Ethereum blockchain. This time may vary depending on network load.

Manage wETH: After the transaction is completed, you will have wETH in your wallet. You can store it, use it in DeFi applications, or even convert it back to ETH at any time.

Capture value and liquidity: WETH retains value like ETH, allowing you to track its value and participate in trading and decentralized financial activities on Ethereum.

Creating wETH through Uniswap is a simple and important process to participate in the DeFi world and leverage your liquidity on the Ethereum network.

Creating wETH with MetaMask

Install and activate MetaMask: If you don’t have MetaMask, you need to download and install this application on your browser. Then, create a wallet and activate it.

Load ETH into MetaMask Wallet: Make sure you have loaded a sufficient amount of ETH to convert to wETH into your wallet.

Access a dApp that supports wETH: Open your browser and access a decentralized application (Dapp) or website where you want to create wETH.

Connect MetaMask Wallet: Typically, the application will ask you to connect your MetaMask wallet to it to make transactions.

Choose the amount of ETH to wrap: On the application interface, you will see the option to choose the amount of ETH you want to wrap into wETH.

Confirm the transaction: After you have chosen the amount of ETH, confirm the transaction on your MetaMask wallet. Consider the exchange rate and transaction fees before confirming.

Wait for confirmation on the blockchain: The transaction will be sent and wait for confirmation on the Ethereum blockchain. This time may vary depending on network load.

Manage wETH in MetaMask Wallet: After the transaction is completed, you will have wETH in your MetaMask wallet. You can view the amount of wETH and ETH in your wallet at any time.

Use wETH: Now you can use wETH in DeFi applications, trade on exchanges, or even participate in yield farming.

Convert wETH back to ETH (if needed): If you want to convert wETH back to ETH, you can perform the reverse process on the application or exchange that supports it.

How to unwrap Ether (WETH)?

Unwrapping Ether (WETH) is the process of converting wETH back to ETH, allowing you to reuse your ETH. Here’s how to do this in detail:

Use Dapp or DeFi Exchange: You need to access a decentralized application (Dapp) or DeFi exchange with the unwrap WETH feature.

Connect Ethereum Wallet: After accessing the application or exchange, you need to connect your Ethereum wallet to make transactions.

Choose the Amount of wETH to Unwrap: You will see the option to choose the amount of wETH you want to unwrap into ETH.

Confirm the Transaction: The application or exchange will display detailed information about the transaction, including exchange rates and transaction fees. Confirm the transaction after checking this information.

Wait for Confirmation on Blockchain: Your transaction will be sent and wait for confirmation on the Ethereum blockchain. Waiting time may vary depending on network load.

Manage ETH in Wallet: After the transaction is completed, you will have ETH in your wallet, unwrapped from wETH. You can use it or even convert it to other cryptocurrencies.

Can you wrap ETH on different blockchains?

Here, Connextfx will explain the concept of wrapping ETH on different blockchains and consider the feasibility of this:

Ethereum (ETH):

Ethereum is the origin of wETH and its operation on this network is the source of wETH.

Wrapped ETH versions on Ethereum such as wETH, cETH (Compound ETH), or aETH (Aave ETH) are mainly based on this platform.

Binance Smart Chain (BSC):

BSC has seen the development of BEP-20 tokens, similar to wETH.

However, wETH does not exist on BSC. Instead, you can use Binance-Peg Ethereum (BETH) to participate in DeFi on BSC.

Polygon (MATIC):

Polygon, a layer 2 of Ethereum, also supports wETH and ERC-20 tokens on it.

This helps speed up transactions and reduce fees on the Ethereum network.

In summary, you can wrap ETH on different blockchains, but the versions of wrapped ETH will depend on the specific network and infrastructure supported on that network. If you want to participate in DeFi on other networks, you need to learn about the corresponding wrapped ETH version on that network.

How does Wrapped ETH maintain the same value as ETH?

Let’s explore with Connextfx how wETH (Wrapped Ether) can maintain the same value as ETH and related factors:

Ensure a 1:1 exchange rate: WETH is usually maintained at a 1:1 exchange rate with ETH, meaning 1 wETH is always equivalent to 1 ETH. This is ensured by having a conversion process of wETH to ETH and vice versa to maintain consistent value.

Developed by reputable projects: WETH is usually developed and managed by reputable projects in the blockchain community like Gnosis or Kyber Network, ensuring reliability and safety for users.

Use in DeFi and dApps: WETH is widely used in DeFi applications and dApps on Ethereum, where it can be collateralized, traded, and used in other similar use cases like ETH.

Smart contract and community support: WETH is protected by smart contracts, and the community often monitors and ensures its integrity.

However, remember that between different blockchains, the value of wETH may change due to market fluctuations and other factors. Maintaining value like ETH requires careful management and community support.

What DeFi applications can use WETH?

Trading on DeFi Exchanges: WETH is often used as a main cryptocurrency for trading on DeFi exchanges like Uniswap, SushiSwap, or Curve Finance. You can easily exchange WETH for other ERC-20 tokens.

Participate in Yield Farming: In yield farming, users provide WETH and receive yield or bonus tokens in the process of creating liquidity for DeFi projects. This helps increase profits from owning WETH.

Borrow and Lend Money in DeFi: WETH is also used as collateral to borrow and lend money on platforms like Aave or Compound. Users can place WETH as collateral to borrow money or lend money with specific interest rates.

Participate in Liquidity Pool: Users can provide WETH and another token to liquidity pools on DeFi exchanges to earn a percentage yield from exchange transactions.

Participate in application selection and invest in new projects: Some DeFi applications allow users to use WETH to participate in the selection and investment in new projects.

Conclusion

With the information shared in the article, we hope you have gained a thorough and comprehensive understanding of WETH, an important concept in the world of cryptocurrency and blockchain. From basic explanations about WETH to detailed guides on how to own it, our goal is to help you grasp and apply this knowledge in practice. Remember, whether you are exploring or ready to participate in the cryptocurrency market, constantly updating knowledge and information is the key to success. Good luck on your journey of discovery and investment. Follow our blog for more exciting and informative articles about cryptocurrency and blockchain technology!