Stepping into the Forex world, you will immediately encounter the term “Pip” – a concept indispensable for any investor. “Guide on How to Calculate Pips in Forex for Beginners” is an article tailored for those new to Forex and wishing to master this most fundamental calculation.

In this article, you will be introduced to the definition of a Pip, its importance in measuring currency pair value fluctuations, and how to apply it in real trading scenarios. Specifically, the article will equip you with a detailed formula for calculating Pips, making it easier for you to calculate profits and risks in your investment ventures.

What is a Pip?

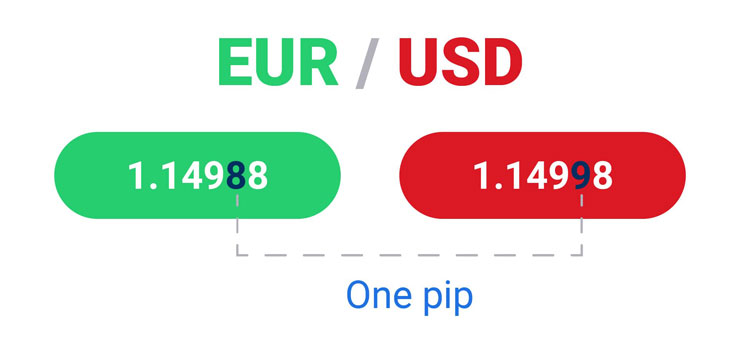

In the foreign exchange market, a Pip is the measurement unit for the change in value between two currencies. One Pip equals a 0.0001 change in the exchange rate for most currency pairs, except for pairs involving the Japanese Yen (JPY), where a Pip is 0.01.

Suppose you are trading the EUR/USD pair, and the current rate is 1.1050. If the rate moves to 1.1051, it means it has increased by 1 Pip. Calculating in Pips allows investors to easily determine profits or losses in trading, and it’s also how most traders communicate with each other about value fluctuations without having to mention specific amounts of money.

How to Calculate the Value of a Pip

A Pip, as explained, is the smallest price move a currency pair can make on the Forex market. For most currency pairs, a Pip equals a 0.0001 change in the exchange rate. However, for pairs involving the JPY, a Pip corresponds to 0.01.

The value of each Pip depends on three factors: the currency pair traded, the size of the lot, and the exchange rate. To calculate the value of a Pip, use the following formula:

Pip Value = (one Pip / exchange rate) * lot size

For example, if you are trading a standard lot (100,000 units) of the EUR/USD pair and the exchange rate is 1.1050, the value of one Pip would be calculated as follows:

Pip Value = (0.0001 / 1.1050) * 100,000 = 9.05 USD

This means, for every Pip movement, you would earn or lose 9.05 USD, depending on the market’s direction. Understanding how to calculate the value of a Pip helps you accurately assess the profit and risk in each trade, making for smarter trading decisions. This is a fundamental skill every Forex investor must possess.

Examples of Calculating Pips in Forex

Suppose you are trading the EUR/USD currency pair. One Pip corresponds to a 0.0001 change for most currency pairs, except for those involving the Japanese Yen (JPY), where a Pip is 0.01. To calculate the Pip value, you need to know the amount of currency you are trading (volume).

For instance, you buy 10,000 EUR/USD at 1.1050 and sell at 1.1060. The difference between the buying and selling price is 0.0010, i.e., 10 Pips. Assuming each Pip is worth 1 dollar, you would make 10 dollars from this trade.

However, the value of each Pip can vary depending on the lot size you are trading and the currency pair. For a standard lot (100,000 units of the base currency), the value of one Pip is usually 10 dollars for pairs not involving the Japanese Yen. For pairs involving the Yen, the Pip value may differ due to the exchange rate.

Some online Pip calculators can help save time and minimize errors. These tools allow you to input the currency amount, lot size, and currency pair to quickly calculate the Pip value.

What Causes Pip Value to Change?

In the Forex trading world, the value of each Pip is not always fixed. It can change depending on various factors, making risk management and profit calculation a bit more complicated. But don’t worry, once you understand what factors affect Pip value, you can adjust your trading strategy accordingly.

One of the main factors is the type of currency you are trading. As mentioned, for most currency pairs, a Pip equals a 0.0001 change in the exchange rate. However, for pairs involving the Japanese Yen (JPY), a Pip is 0.01. This difference is due to the lower value of the Yen compared to other currencies, requiring a larger magnitude of change to be significant.

The lot size of the trade is also an important factor. In Forex, you can trade with different lot sizes: standard lot (100,000 units of currency), mini lot (10,000 units), and micro lot (1,000 units). The Pip value changes depending on the lot size you choose; the larger the lot size, the higher the Pip value, and vice versa.

The exchange rate also affects the Pip value. As the exchange rate of the currency pair you are trading changes, the value of each Pip in the base currency also changes. This is especially important when trading currency pairs where the base or counter currency is not the currency of your trading account, as you need to convert the Pip value to your account currency to calculate profits and losses accurately.

Finally, market volatility can also cause Pip value to fluctuate. In periods of high volatility, Pip value can change rapidly, requiring traders to be extremely cautious when managing risk and placing stop-loss orders.

Being aware of these factors helps me develop a flexible trading strategy that adapts to all market conditions. The most important thing is always to be ready to learn and adapt, as the Forex market is constantly changing, and knowledge is the key to success.

Trading Pips with Top Forex Brokers Today

When choosing a broker, it’s important to look for ones that offer a stable trading platform, competitive trading fees, and, especially, educational and technical analysis tools so you can accurately track and forecast Pip values.

Connectfx, one of the top brokers today, stands out with its excellent customer service and an advanced trading platform. This makes it easier for investors, especially beginners, to access and analyze the market, thereby making informed trading decisions based on Pip values.

Besides Connectfx, many other brokers also offer good services for investors. However, what makes Connectfx special is its commitment to transparency and fairness in all transactions. They also provide free courses and webinars to help investors enhance their trading knowledge and skills, including calculating and leveraging Pip values.

Choosing the right broker is not just about finding the lowest costs or the easiest-to-use trading platform; it’s about finding a trustworthy partner who can support you throughout your trading journey. With support from Connectfx, you can rest assured that you will be fully equipped with the knowledge and tools necessary for effective Pip trading, thereby maximizing your profits and minimizing risks in your Forex trading ventures.