Are you delving into the world of Forex trading, one of the largest sectors of the global financial market with over 2 trillion USD traded daily? With the increasing number of newcomers, mastering the basic aspects of FX trading, especially pending orders, has become more important than ever. “Pending Orders: A Basic Guide for Beginners” will be a valuable guide for you.

What are Pending Orders?

Pending Orders, or pending orders, are an indispensable tool in Forex trading, especially for beginners. These are orders that you place in advance to buy or sell a currency at a price that is not the current market price. Pending orders allow you to “bet” on your market fluctuation predictions without having to sit in front of the computer screen all day.

Using pending orders means you are expecting the market to move in a certain direction, and you want to take advantage of that opportunity. For example, if you predict that the EUR/USD price will rise and want to buy when the price reaches a certain level lower than the current price, you can place a Buy Limit order. Conversely, if you expect the price to drop after reaching a certain high point, you can use a Sell Limit order.

The benefit of using pending orders is that you can plan your trades in advance and automate the trading process. This helps reduce pressure and allows you to better control your trading decisions. However, remember that the Forex market is very volatile and nothing is certain. Therefore, using pending orders should also be based on thorough analysis and a planned trading strategy.

4 Types of Pending Orders

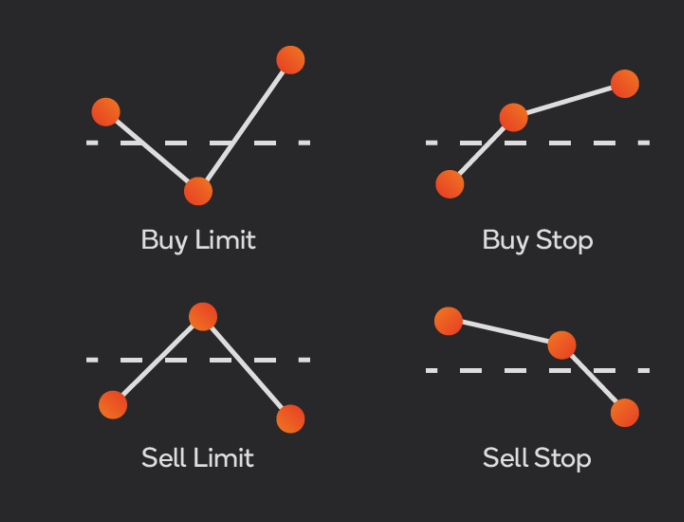

Here are details on the 4 most common types of pending orders that you will frequently use in your trading activities.

- Buy Limit: A Buy Limit order is used when you want to buy a currency at a price lower than the current market price. This means you are expecting the market to drop to the price you have chosen before it rises again. This order is very useful for catching the market bottom or buying in at the lowest possible price.

- Buy Stop: A Buy Stop order is the opposite of a Buy Limit. You place this order when you want to buy a currency at a price higher than the current market price, expecting that once the price reaches that level, it will continue to climb higher. A Buy Stop order is often used when you expect a price increase trend to start after surpassing a certain threshold.

- Sell Limit: A Sell Limit order is when you want to sell a currency at a price higher than the current market price. This is a good strategy for “locking in profits” when you expect the market to rise to a specific price before falling back. Using this order helps you sell at the desired price, maximizing profit.

- Sell Stop: Lastly, a Sell Stop order is placed when you want to sell a currency at a price lower than the current market price, predicting that the price will continue to fall after passing a certain decrease threshold. This order is suitable for minimizing risk or “cutting losses” in case the market moves against your prediction.

Each type of pending order has its specific applications and aims to help investors maximize profits and minimize risks. Using these orders flexibly and smartly will be the key to your success in the Forex trading world.

Conclusion

It’s no exaggeration to say that pending orders open up a new world with more flexible and efficient trading possibilities. Whether you’re dealing with major currency pairs or exotic ones, understanding and mastering pending orders can be the key to maintaining your performance in this fast-paced and volatile trading environment.

From automatically locking in profits to minimizing risk, pending orders not only save you time but also help optimize your trading strategy. For me, it’s not just a trading tool but an essential part of my personal risk management plan. I hope through this article, you too can feel the power of pending orders and are ready to apply them in your trading.