You’ve probably heard the term “Introducing Broker,” but do you truly understand it? In this article, “Introducing Broker: The Golden Gate of the Financial Market,” we will delve deep into the world of Introducing Brokers (IB), important yet sometimes misunderstood figures in the financial industry. IBs are not just a mere term; they play a pivotal role as a bridge between investors and the market, opening up significant opportunities and potential for both sides. Join us as we uncover the mysteries behind this golden gate and see how it can become the key to your success in the investment world.

Understanding what an introducing broker is?

What is an introducing broker? Simply put, it’s an individual or organization that connects investors with financial trading platforms. They act as a bridge, helping investors find safe and effective investment venues. I am excited to discuss their role because they do more than just introduce clients; they also provide advice, support, and even training for investors.

An interesting thing is that each IB has their own style and approach. They are truly diverse, ranging from individuals with financial experience to large organizations. This creates a diverse and rich environment for the financial market.

Why are they important? I think they are like guides in the dense forest of the financial market. They help investors avoid common mistakes and find the best investment opportunities. That’s why I always advise newcomers to thoroughly understand IBs before making their investment decisions.

Is an introducing broker necessary?

Is an introducing broker necessary? This question often comes up in our discussions at connextfx.com. I want to share my personal view on this. In my opinion, introducing brokers are not only necessary but also extremely important in the modern financial market.

Imagine the financial market as a multi-colored painting, where each investor has their own needs and goals. Here, the introducing broker acts as a guide, helping investors navigate through the vast information jungle. They do more than introduce trading platforms; they also provide information, knowledge, and even investment strategies. This helps investors avoid unnecessary risks and optimize profits.

From an expert’s perspective, I feel introducing brokers play a core role in maintaining the transparency and efficiency of the market. They not only help new investors safely access the market but also support experienced investors in finding new opportunities. In other words, they are coordinators, ensuring that the financial market operates smoothly and efficiently.

Therefore, in my opinion, introducing brokers are not just necessary; they are an indispensable part of the modern financial system. They contribute to the stability and development of the market, facilitating both investors and trading platforms to grow sustainably.

How to become an introducing broker

To become an introducing broker (IB), there are several important steps you need to take. First and foremost, you need a clear understanding of the financial market and the products you will introduce. Professional knowledge is the basic foundation for providing accurate and useful information to your clients.

Next, choosing a reputable brokerage firm to collaborate with is crucial. You need to find a trading platform that is reputable, offers good cooperation conditions, and suits your working style. My advice is to thoroughly research and compare the terms and services of different trading platforms before deciding.

Additionally, building a client network is also important. Being an IB is not just about introducing clients; it also involves building and maintaining good relationships with them. This requires good communication, negotiation, and persuasion skills. I always emphasize that trust and reputation are the keys to success in this profession.

Finally, keeping up with knowledge and market trends is indispensable. The financial market is always fluctuating, and staying updated will help you provide the best advice to your clients. I usually spend time every day researching and following financial news, and I advise you to do the same.

Becoming an introducing broker requires patience, diligence, and continuous learning. If you pursue this career with passion and thorough preparation, you will have the opportunity to build a successful and meaningful career.

How introducing brokers operate

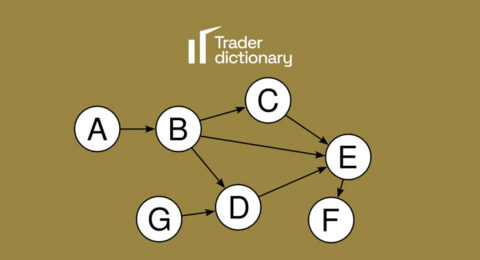

Firstly, IBs operate based on a partnership with trading platforms. They sign contracts with these platforms to become agents introducing clients. Each time they successfully introduce a new client, they receive a commission. This motivates IBs to constantly expand their network and search for potential clients.

Importantly, IBs are not just introducers. They also provide consultancy and support to clients throughout the investment process. This includes providing market information, technical analysis, and even training on how to use the trading platform. I feel that their role is not just as an intermediary but also a valuable source of information, helping investors make informed decisions

An additional special point is that IBs often have deep expertise in specific areas of the financial market, such as stocks, currencies, commodities, or even cryptocurrencies. This enables them to become experts in their field and offer professional, customized services based on the specific needs of clients.

Overall, the operation of IBs plays an important role in connecting clients with the financial market, as well as supporting them in every step of their investment journey. They are an indispensable part of the financial ecosystem, making the market more accessible and approachable for everyone.

The role and responsibilities of introducing brokers

One of the primary roles of IBs is to act as a bridge between clients and trading platforms. They introduce clients to platforms, helping them find investment venues that match their needs and goals. This involves more than just simple introductions; it also includes providing information and advice about investment products, helping clients understand opportunities and risks.

Additionally, IBs have a responsibility to support clients. They offer technical support, answer queries, and guide the use of the trading platform. In my eyes, they are like trustworthy guides, always ready to support clients at every step.

Another important part of the IB’s job is to maintain transparency and legal compliance. They must ensure that all trading activities comply with the regulations and laws of the financial market. This not only protects client interests but also contributes to maintaining stability and integrity in the market.

In summary, the role of IBs goes beyond just introducing clients. They are an essential part in building and maintaining a healthy, transparent, and efficient financial market. In my view, they truly play a key role, not only helping clients achieve their investment goals but also contributing to the sustainable development of the entire financial system.

The relationship between IB and FCM

The relationship between Introducing Broker (IB) and Futures Commission Merchant (FCM) is truly a core part of the financial market structure, especially in the field of futures trading. From my experience at connextfx.com, I understand that the collaboration between IB and FCM is not only important but also beneficial for both parties and investors.

FCMs are companies authorized to directly trade on futures exchanges and are responsible for managing client accounts, protecting their deposits, and ensuring compliance with regulations. Meanwhile, IBs act as intermediaries, introducing and supporting clients in opening accounts with FCMs.

This relationship creates an effective working mechanism: IBs provide personalized service and support to clients, while FCMs focus on risk management and executing trades. This optimizes the client experience, as they receive professional care from both IB and FCM.

Additionally, this relationship also ensures legal compliance and regulations. FCMs have the responsibility to supervise the activities of IBs, ensuring they adhere to necessary regulations. This not only protects client interests but also helps maintain transparency and credibility in the financial market.

I notice that the relationship between IB and FCM is very important in maintaining a stable and efficient financial market. The cooperation between them creates a multi-tiered system, where each party contributes to the overall success of the financial market and the investment experience of clients.

The commissions that introducing brokers will receive

Firstly, it’s important to understand that the commission of an IB is not a fixed amount. It usually depends on the number of clients that the IB introduces and the trading volume generated by these clients. This means that the more clients and the more trades, the more commission the IB has the opportunity to earn.

Commissions are typically calculated as a percentage of the spread or the transaction fee that clients pay to the trading platform. Each platform has different calculations, but typically, an IB can receive from 10% to 50% of the spread or transaction fee. This creates a strong incentive for IBs not only to seek new clients but also to maintain good relationships with existing ones.

Some platforms also offer additional bonus programs or tiered commissions based on the performance or activity level of the introduced clients. This not only increases earning opportunities for IBs but also encourages them to provide the best service to their clients.

In conclusion, commissions are an important part of an IB’s income. The level of commission depends on various factors such as the policy of the trading platform, the number and activity of clients. This is the main motivation that keeps IBs continuously striving to develop their client network and maintain good relationships with them.

Why is the introducing broker profession becoming popular now?

Firstly, the development of the global financial market has opened up many new

investment opportunities. This requires support and guidance from experts with deep knowledge, and this is where IBs become important. They help investors understand the opportunities, risks, and ways to effectively participate in the market.

Secondly, the convenience of technology has made the IB profession more accessible. With the internet and online trading platforms, IBs can work from anywhere, creating a flexible business model and attracting many participants.

Additionally, the diversity in investment products also creates a demand for professional advice and support from IBs. They provide detailed information about products such as stocks, bonds, currencies, commodities, and even cryptocurrencies, helping investors make informed decisions.

Lastly, the attractive income from commissions and bonus programs is another significant factor drawing people to this profession. The flexibility of the job and the potential for high earnings are undeniable attractions of the IB profession.

In summary, the development of the financial market, technology, product diversity, and lucrative income opportunities are the main reasons why the IB profession is becoming increasingly popular. It truly is a profession full of potential and opportunities in the modern financial world.

Is an introducing broker legal?

Is an introducing broker (IB) legal? This is an important question that I often receive from many people, and the answer is yes. At connextfx.com, we always emphasize the importance of complying with the law in all business activities, and the IB profession is no exception.

To operate legally, an IB needs to be licensed and comply with the regulations of financial regulatory authorities. In many countries, IBs need to register with regulatory bodies such as the Securities and Exchange Commission (SEC) in the USA or the Financial Conduct Authority (FCA) in the UK. This ensures they adhere to standards of transparency, risk management, and client protection.

Additionally, IBs must also closely monitor and comply with regulations on anti-money laundering and counter-terrorism financing. This not only protects them from legal risks but also helps maintain transparency and credibility in the financial market.

I feel that legality and compliance are fundamental in building trust and reputation with clients. A legal IB not only benefits themselves but also contributes to maintaining a healthy and stable financial market.

Therefore, if you are considering becoming an IB or working with one, ensure that they fully comply with legal regulations. This not only helps you avoid risks but also ensures that you are participating in a transparent and professional financial system.

Conclusion

Through the information shared, you can see that the IB profession is not just a job, but a gateway to numerous opportunities and possibilities for both investors and IBs themselves. Remember, success in the financial market comes not only from knowledge but also from choosing the right support and guidance. I wish you luck and success on your investment journey, and don’t forget to follow connextfx.com for more insightful knowledge!