In the rapidly evolving world of cryptocurrency, ICO (Initial Coin Offering) has become a familiar yet complex concept. This article aims to provide a clearer understanding of ICOs, from basic definitions to their operation and distinctive features. We will also share tips and experiences to help you approach ICOs intelligently and safely. Join us in exploring the significant aspects of Initial Coin Offerings in this fascinating world of cryptocurrency!

What is an Initial Coin Offering (ICO)?

An Initial Coin Offering, or ICO, is a popular fundraising method in the world of cryptocurrency. It involves new tokens being issued by companies and sold to the public to fund their projects. ICOs not only create opportunities for startups to attract investment but also offer a novel way for investors to access digital assets.

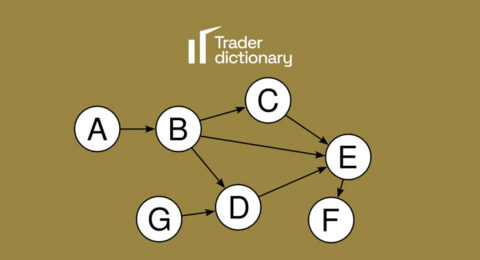

The ICO process begins with the company publishing a project plan, often called a Whitepaper. This document includes detailed information about the project, goals, the number of tokens to be issued, distribution methods, and the use of the funds raised. Subsequently, tokens are sold to the public. Investors buying tokens during the ICO phase often hope the value of the tokens will increase following the project’s development.

However, it’s important to note that ICOs can also pose risks. Many ICO projects fail or are even fraudulent, resulting in total investment losses. Therefore, thorough research before participating in any ICO is crucial. This includes carefully examining the Whitepaper, the development team, the project’s real potential, and community feedback.

How Does an Initial Coin Offering (ICO) Work?

Understanding the workings of an Initial Coin Offering (ICO) is critical, especially if you are considering investing in them. An ICO is a characteristic fundraising method in the cryptocurrency field, where companies offer digital tokens to raise capital for their projects.

This process starts with the development company publicizing their idea and business plan through a Whitepaper. This document details the project, including goals, product development plans, financial structure, and information about the founding team.

The company then launches a widespread promotional campaign to attract investors. During this phase, they sell their tokens, typically in exchange for cryptocurrencies like Bitcoin or Ethereum. Investors purchase tokens in the hope that their value will increase as the project develops.

However, it’s important to understand that not all ICOs are successful. Many projects fail to achieve their goals, leading to a devaluation of the tokens. This requires investors to conduct thorough research before participating in any ICO, including a careful evaluation of the Whitepaper, market potential, and the capabilities of the founding team.

Issuing a White Paper

In the process of executing an Initial Coin Offering (ICO), issuing a White Paper is an indispensable step. This document contains all the necessary information about the project, helping investors to understand more about the goals and plans of the ICO.

- Project Overview Description: The White Paper provides an overview of the project, including the idea, objectives, and the value that the project aims to deliver.

- Details About the Product or Service: This document specifically describes the product or service that the ICO supports, as well as why they are valuable and necessary.

- Information About the Development Team: Provides information about the experience and capability of the development team, including backgrounds and notable achievements.

- Market Analysis and Competitive Landscape: Analyzes the target market, potential for growth, and evaluates current competitors.

- Financial Structure and Token Distribution: Describes the method of token distribution, financial structure, and the usage of capital raised from the ICO.

- Development Roadmap: Presents a specific roadmap of the project’s development stages, from inception to completion and deployment.

- Legal Information and Compliance: Provides legal information, including compliance with relevant regulations and laws.

- Risks and Warnings: Clearly outlines potential risks and warnings for investors, helping them to have a realistic view and carefully consider before investing.

Who Can Issue an ICO?

In the world of cryptocurrency and blockchain, the issuance of an Initial Coin Offering (ICO) is not limited to companies or businesses. Here’s what you need to know about who can issue an ICO:

- Startups and New Businesses: Newly established companies, especially in technology and blockchain, often use ICOs as a means to raise funds.

- Independent Blockchain Projects: Groups or individuals developing blockchain projects can issue ICOs to raise capital for their projects.

- Expanding Companies: Companies already in operation but looking to expand activities or develop new products can leverage ICOs.

- Research and Development Teams: Technology research groups, particularly in digital and blockchain technology, can use ICOs to fund their research.

- Angel Investors and Venture Capital Organizations: They can organize or support the issuance of ICOs for projects they believe in.

- Individuals and Small Groups: Even individuals or small groups with breakthrough ideas can issue ICOs, provided they have a clear plan and comply with legal requirements.

- Non-Profit Organizations: Non-profit organizations wanting to fund initiatives can use ICOs as a means to raise funds.

Purchasing ICOs

When deciding to purchase ICOs, there are several important factors that need to be thoroughly considered. Here are the points you should pay attention to when participating in an Initial Coin Offering:

- Detailed Research on the Project: Before buying tokens from an ICO, conduct thorough research on the project, including reading the Whitepaper and understanding the goals and development plans of the project.

- Assessing the Project’s Feasibility: Evaluate the feasibility of the project, including its technical aspects, target market, and growth potential.

- Checking the Credibility of the Development Team: Investigate the background and experience of the project’s development team to ensure they are capable of executing the project.

- Understanding the Structure and Purpose of the Tokens: Analyze the structure of the tokens and how they will be used in the project’s system.

- Clear Awareness of Risks: Be fully aware of the risks involved in participating in ICOs, including legal, technical, and market risks.

- Checking Legal Conditions and Compliance: Ensure that the ICO project complies with relevant legal regulations.

- Considering Reviews and Feedback from the Community: Read reviews and feedback from the community about the project to get an overall and objective perspective.

- Determining Your Investment Goals: Clearly define your investment goals and consider whether the ICO project aligns with those goals.

- Caution with Overpromising Advertisements: Be cautious of overly optimistic advertisements and promises of unrealistically high returns, always maintain a realistic perspective.

Initial Coin Offering (ICO) so với Initial Public Offering (IPO)

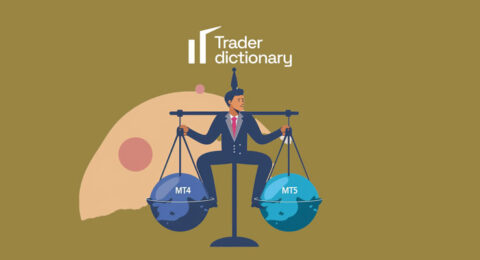

When comparing Initial Coin Offering (ICO) with Initial Public Offering (IPO), there are several key points to note in order to understand the differences between these two forms in the world of finance and investment.

- Nature: An IPO is the process by which a company offers its shares to the public for the first time, while an ICO involves issuing digital tokens to raise funds for a blockchain project.

- Legal Regulations: IPOs are strictly regulated by financial regulatory authorities and stock markets, whereas ICOs are often less regulated and can quickly reach a large number of investors.

- Risk and Transparency: IPOs are generally considered less risky than ICOs due to requirements for transparency and clear financial reporting, while ICOs have higher risks due to a lack of transparency.

- Time and Cost: Conducting an IPO usually takes a lot of time and is expensive, whereas ICOs can be executed quickly and at a lower cost.

- Investor Rights: Investors buying shares in an IPO acquire ownership in a portion of the company, while investors buying tokens in an ICO do not necessarily own a part of the company but often have rights to use future products or services.

- Market Access: IPOs are typically only open to large investors and financial institutions, while ICOs can reach everyone globally through the internet.

Advantages and Disadvantages of Initial Coin Offerings

When considering participation in an Initial Coin Offering (ICO), understanding its advantages and disadvantages is crucial. Here are the main pros and cons of ICOs:

Advantages:

- Broad Accessibility: ICOs allow projects to reach a large number of investors worldwide, expanding fundraising opportunities.

- Transparency and Easy Access: Information about ICOs is usually widely published, making it easy for investors to learn about and participate in them.

- High Flexibility: ICOs can accommodate various types of projects and do not require a complex process like IPOs.

- Opportunity for New Projects: New projects, especially in the technology sector, can leverage ICOs to attract funding.

Disadvantages:

- High Risk: Many ICOs fail to meet their objectives, posing a high risk of total loss for investors.

- Lack of Regulation: ICOs are less controlled by regulations, leading to risks of fraud and scams.

- Token Price Volatility: The value of tokens can fluctuate significantly, posing risks to investors.

- Challenges in Project Evaluation: Assessing an ICO project requires specialized knowledge and analytical skills.

- Liquidity and Convertibility Issues: Converting tokens into cash or other assets can be challenging, affecting the liquidity of the investment.

Examples of Initial Coin Offerings

When discussing Initial Coin Offerings (ICOs), there are several standout examples that have left a mark in the history of the cryptocurrency market. Here are some notable examples:

Ethereum (ETH): One of the most successful ICOs, Ethereum attracted a significant amount of investment in 2014. This project paved the way for the development of smart contracts and decentralized applications.

Neo (formerly Antshares): Often dubbed the “Ethereum of China,” Neo had a successful ICO in 2016, drawing considerable attention from the cryptocurrency community.

EOS: EOS conducted one of the largest ICOs in 2017, raising billions of dollars. The project aimed to build a blockchain platform for decentralized applications.

Tezos: Tezos also made a significant impact in the ICO community, raising approximately 232 million US dollars in 2017.

Filecoin: The ICO of Filecoin garnered attention by raising 257 million dollars, aiming to develop a decentralized storage network.

These examples highlight the allure and potential of ICOs in raising capital, as well as their ability to bring about significant changes in blockchain technology and the cryptocurrency market. However, it’s also important to note that not all ICOs are successful, and investing in ICOs always comes with risks.

How to Identify When a New Coin is Released

To stay informed about the release of new coins, particularly in the field of Initial Coin Offerings (ICOs), an effective information strategy is essential. Here are some ways to stay updated and recognize when a new coin is released:

- Follow Reputable Cryptocurrency Websites: Many cryptocurrency news and analysis websites regularly update information about upcoming ICOs.

- Join Cryptocurrency Communities: Online forums and groups such as Reddit, Telegram, or social media groups often discuss new and potential ICOs.

- Subscribe to ICO Newsletters: Many ICO websites offer newsletter services, where you can receive information directly via email.

- Follow Cryptocurrency Bloggers and Influencers: Influential figures in the cryptocurrency community often update information about new ICOs and analyze them.

- Participate in Blockchain and Cryptocurrency Events: These events are often venues for announcing and discussing new ICO projects.

- Read Project Whitepapers: To understand an ICO thoroughly, you should read its Whitepaper for detailed information and development plans.

- Check Information on Cryptocurrency Exchanges: Major exchanges often announce the listing of new coins, including those from ICOs.

Is an Initial Coin Offering (ICO) Legal?

The legality of an Initial Coin Offering (ICO) depends on various factors, including the legal regulations of each country and the execution method of each ICO. Here are some points to consider in assessing the legality of an ICO:

Legal Regulations in Each Country: Each country has its own legal regulations regarding ICOs. In some countries, ICOs are completely legal, while others may restrict or outright ban them.

Compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC): ICOs need to adhere to AML and KYC regulations to prevent illegal financial activities.

Business Model and Purpose of Tokens: It’s necessary to determine whether the issued tokens are considered securities. If they are, the ICO must comply with securities regulations.

Transparency and Reporting: ICOs need to provide transparent and complete information about the project, including risks, capital use plans, and information about the management team.

Regulatory Body Scrutiny: Some ICOs choose to undergo scrutiny by financial regulatory bodies to enhance transparency and credibility.

Overall, the legality of an ICO must be evaluated based on various factors, including the legal regulations of the country where the project is implemented, as well as the deployment and management approach of the ICO. This requires investors to conduct thorough and cautious research.

What Are the Purposes of Initial Coin Offerings (ICOs)?

Initial Coin Offerings (ICOs) are a unique financial tool in the world of cryptocurrency, widely used for various purposes. Here are the main purposes for which ICOs are typically used:

Fundraising for New Projects: ICOs are commonly used by startups to raise funds for new technology projects, especially in blockchain and cryptocurrency fields.

Product or Service Development: Many projects use the capital raised from ICOs to develop and improve their products or services, ranging from trading platforms to decentralized applications.

Building and Expanding the Community: ICOs help projects build and expand their community, as token purchasers are often supporters and users of the product.

Testing New Business Models: Some ICOs are used to test new and innovative business models, especially in unregulated environments.

Driving Project Development: Capital raised from ICOs helps motivate and provide resources for rapid project development.

Avoiding Dependence on Traditional Investment: ICOs offer an independent fundraising method, helping projects avoid reliance on traditional venture capital investment.

Creating New Investment Opportunities: ICOs open up new investment opportunities for those looking to participate in the cryptocurrency and blockchain market, even for those with limited knowledge of the field.

In conclusion, ICOs are a flexible funding tool, supporting new and innovative projects while creating opportunities for both developers and investors. However, the success of an ICO depends not only on the project idea but also on transparency and effective risk management.

Conclusion

We hope you have gained a deep and comprehensive understanding of the world of ICOs. This is not just an innovative fundraising method but also an opportunity for creative and breakthrough projects to develop. However, like any investment opportunity, ICOs come with inherent risks and require thorough research. We hope the information we provide will help you make smart and safe decisions when approaching the ICO market. Continue to follow our blog for more valuable knowledge in the world of cryptocurrency and investment. Good luck and success to you!