Are you looking for opportunities to generate profits from the global DeFi market? “Yield Farming” might be the concept you need to explore. It’s one of the most popular ways to earn higher than average returns by depositing cryptocurrency into yield farming protocols. This article will help you understand more about Yield Farming and how it operates. Whether you’re a financial expert or just beginning to explore the world of cryptocurrency, the information below will provide a comprehensive and deep insight into this attractive investment opportunity. Let’s dive in!

What is Yield Farming?

Yield Farming, also known as “profit farming,” is one of the most prominent investment strategies in the world of cryptocurrency and decentralized finance (DeFi). It involves users staking or lending their cryptocurrency on a DeFi platform to receive returns, often in the form of another cryptocurrency. The return rate can vary significantly depending on the project and the market, but sometimes it’s enticing enough to attract a large amount of capital from investors. Yield Farming operates based on a reward mechanism for those who provide liquidity to smart contracts. By depositing money into a liquidity pool, you’ll receive a reward based on the percentage of the pool you hold. This not only helps DeFi projects have enough resources to operate but also facilitates the exchange and borrowing of assets flexibly and efficiently.

How Does Yield Farming Work?

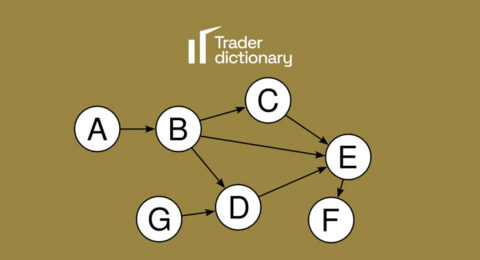

Yield Farming operates on a basic principle: liquidity providers (also called yield farmers) deposit their tokens into a DeFi application. In return, they receive rewards paid in the protocol’s token. This process can vary depending on the protocol, but the essence remains the same. Rewards from Yield Farming are expressed as APY (annual percentage yield). The users’ tokens are locked in a smart contract, which automatically rewards users with tokens as they meet certain conditions. The Yield Farming process typically includes the following steps:

- Choose a Yield Farming protocol. For instance, we might select an automated market maker (AMM) like PancakeSwap.

- On the decentralized trading platform, select ‘Liquidity’ to access the section for liquidity providers.

- Then, choose the assets you want to deposit into a liquidity pool. For example, you could deposit BNB and CAKE into the BNB/CAKE pool.

- Deposit the two assets into the trading pool and receive an LP token.

- Take that LP token, go to ‘Farms,’ and deposit it into the BNB/CAKE yield farm to earn your Yield Farming rewards (in addition to the transaction fees you receive as part of the liquidity pool). Many DeFi protocols reward yield farmers with governance tokens, which can be used to vote on decisions related to the platform and can also be traded on exchanges. This process not only facilitates the optimization of returns through liquidity provision but also allows participants to have a say in the governance of the protocol, opening up a potential investment channel for users who want to actively participate in the DeFi ecosystem.

Types of Yield Farming

Below are the three most common types of Yield Farming you may encounter in the Crypto world.

- Liquidity Providing (LP): When participating as a liquidity provider, you will deposit your cryptocurrency assets into a decentralized exchange (DEX) and receive a percentage from the trading fees.

- Staking: There are several forms of staking in Crypto. The first form occurs at the protocol level of a Proof-of-Stake blockchain. The second form is a limited-time opportunity to earn extra yield for being an LP.

- Lending: DeFi allows people to borrow cryptocurrency assets from a pool of lenders. The lenders receive yield from the interest borrowers pay.

Benefits and Risks of Yield Farming

Yield Farming has become an attractive investment strategy in the world of cryptocurrency, offering exciting profit opportunities for investors. However, like any investment opportunity, Yield Farming also comes with its own set of risks. Here’s an overview of the benefits and risks of Yield Farming.

- Benefits of Yield Farming:

- Passive Income: The most evident benefit of Yield Farming is the ability to earn passive income. By depositing your cryptocurrency assets into DeFi projects, you can earn additional returns.

- Asset Utilization: Yield Farming allows you to utilize idle cryptocurrency assets. Instead of keeping them in a wallet, you can use them to generate additional income.

- Participation in Governance: Many DeFi projects reward users with governance tokens, allowing them to have a say in shaping the project’s future.

- Risks of Yield Farming:

- Risks from DApp Developers: Some DApp developers may not be trustworthy, leading to your money being stolen or misused.

- Smart Contract Errors: Smart contracts may contain errors or security vulnerabilities, putting your assets at risk of being locked or stolen.

- Market Volatility and Impermanent Loss: Market fluctuations can lead to impermanent loss, especially in DEX liquidity pools, when the value of the assets you deposit changes compared to when you deposited them. To minimize risks when participating in Yield Farming, thoroughly researching projects before depositing money is crucial. Opting to engage in projects with a long operating history and reputation can help protect you from unnecessary risks.

Conclusion

Following the collapse of TerraUSD last year, interest in Yield Farming has decreased, and returns are not as high as before. However, for savvy investors willing to face challenges such as market volatility, scam risks, and regulatory uncertainties, Yield Farming remains an indispensable part of their investment strategy. Looking back on the journey, Yield Farming reminds us that every investment opportunity carries risks. But with thorough preparation and deep understanding, we can optimize opportunities and effectively minimize risks. This is not just a lesson about investment but also about patience, courage, and decisiveness in all life’s decisions.